Tax Calculator 2025 Kenya. Your average tax rate is 17.9%. If you make ksh 24,000 a year living in kenya, you will be taxed ksh 4,301.

Calculate your income tax, social security and pension deductions. If you make ksh 24,000 a year living in kenya, you will be taxed ksh 4,301.

Vat Calculator 2025 Kenya Raf Leilah, If you make ksh 24,000 a year living in kenya, you will be taxed ksh 4,301.

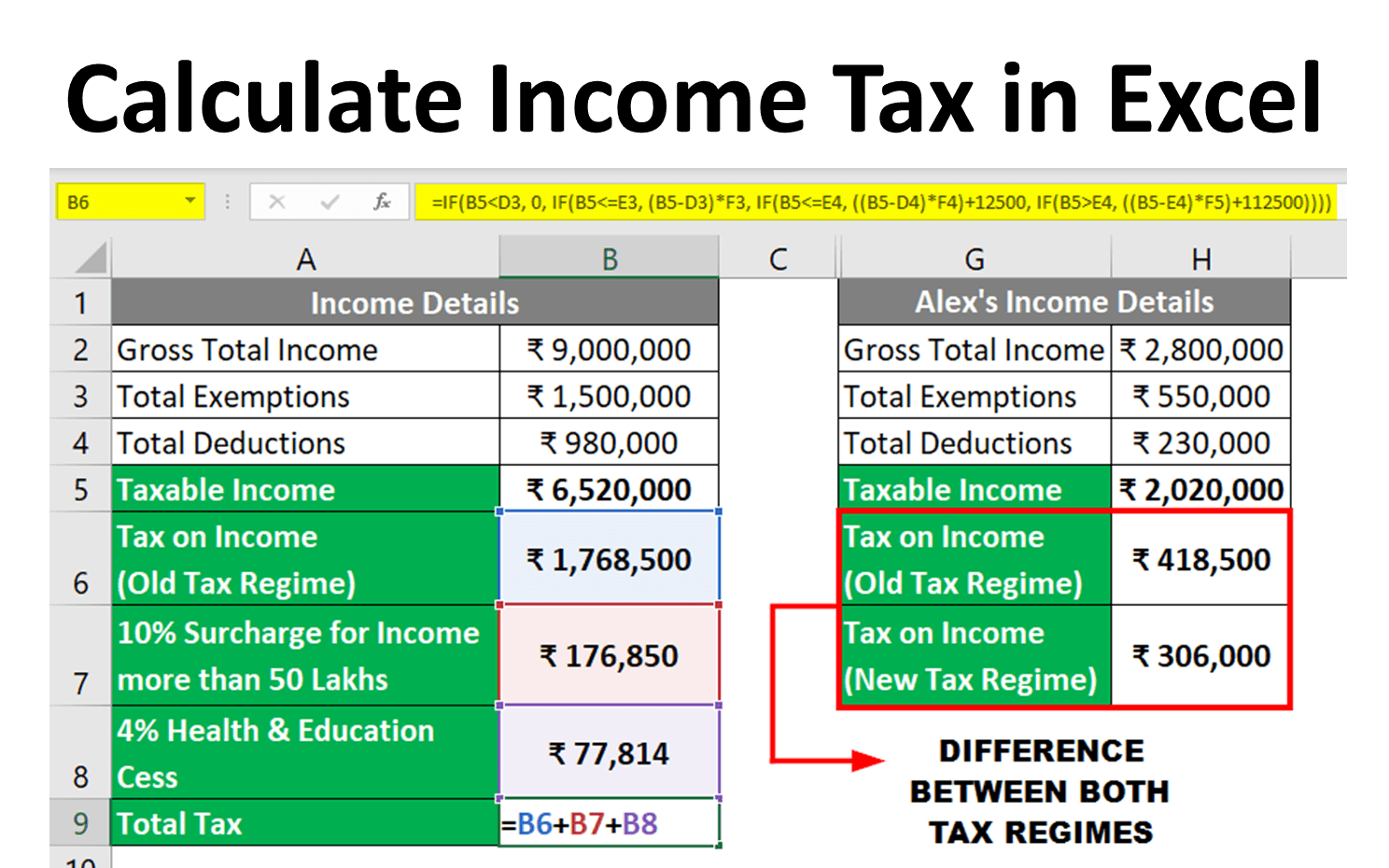

Kenya Tax Tables 2025 Tax Rates and Thresholds in Kenya, Calculate you daily salary after tax using the online kenya tax calculator, updated with the 2025 income tax rates in kenya.

Tax Calculator 2025 Kenya Zonda Krystyna, Calculate your income tax in kenya and salary deduction in kenya to calculate and compare salary after tax for income in kenya in the 2025 tax year.

1115k Salary After Tax in Kenya KE Tax 2025, Use our updated paye calculator to calculate on how statutory deductions such as paye, nssf, shif (formerly known as nhif), & affordable housing levy will affect your net pay.

Free Tax Calculator for FY 202324 (AY 202425), — kenya payroll calculator with income tax rates of 2025 | calculate paye, net pay, nhif and nssf pension.

593.5k Salary After Tax in Kenya KE Tax 2025, That means that your net pay will be ksh 30,517 per year, or ksh 2,543 per month.